For small and medium sized (SME) manufacturers using plastic packaging.

What is it?

The Plastic Packaging Tax (PPT) was introduced on 1 April 2022 to encourage UK businesses to be more eco-friendly. This tax applies to plastic packaging that is manufactured in or imported into the UK – filled or unfilled – and contains less than 30% recycled plastic. It was originally charged at a rate of £200 per tonne, but from 1 April 2023, the price went up to £210.82 per tonne.

Why was it introduced?

PPT had been in the works since 2017 when the government first proposed using the tax system to tackle single-use plastic waste. The idea was to stimulate business demand for recycled plastic. It was anticipated the knock-on effects would be an increase in the levels of recycling and waste collection, and a reduction in plastic waste being incinerated or going to landfill.

At the time, the government estimated it would lead to a 40% increase in the use of recycled plastic in 2022-23, equal to savings of nearly 200,000 tonnes of CO2 emissions.

Do I have to register for PPT?

No. Plastic packaging manufacturers and importers into the UK are the businesses that are directly affected by this tax. Regardless of their size or sustainability credentials, they are the ones who will have more paperwork.

These organisations must register for Plastic Packaging Tax with HMRC if they make or import at least 10-tonnes of finished plastic packaging components into the UK each year. Components usually being items manufactured separately before being assembled into a packaging unit (for example, plastic trays, boxes, windows, and labels).

This includes non-residents who import into the country, unincorporated bodies such as partnerships, and business groups.

So, how does PPT affect me?

It depends on the type of packaging you’re buying to protect your products. If your packaging contains at least 30% recycled plastic, or no plastic at all, then you’re not affected.

If it is made of plastic but has less than 30% recycled content, your packaging is going to cost more money.

The good news is the additional cost should be minimal for now, and you don’t have to do any tricky paperwork. The onus is not on you to provide or chase documents confirming what the packaging is made of or proving that PPT has been paid. For example, if you are buying your packaging from us at Actionpoint, we take care of that.

Having said that, now is a good time to take stock of your packaging requirements. Firstly, because any price increase, no matter how slight, should prompt a look around to see if there are cheaper alternatives available – such as packaging that is not subject to PPT.

And secondly, it is likely that this is only the start and PPT requirements will become more demanding in the future. This could result in a bigger fee per tonne of plastic made or imported, a stipulation for a higher percentage of recycled content, or both. Either way, this means more expense as the additional cost trickles down to you.

Why is this a likely scenario? Plastic Packaging Tax is part of the government’s strategy to achieve net zero greenhouse gas emissions by 2050; a target enshrined in law by the 2008 Climate Change Act. Ministers are under enormous pressure to meet this legal duty.

In October 2021, the government published the Net Zero Strategy paper to, you guessed it, explain how it plans to meet net zero. The idea is to move towards a circular economy. There is a huge emphasis on creating products with a longer useful lifespan, using sustainable materials, reducing waste, and ramping up recycling.

But we have a long way to go. A report by the UK’s National Infrastructure Commission, issued just one month later (November 2021), shows that recycling rates have plateaued, while waste levels – and the emissions from waste incineration – are on the rise. Its message was that greenhouse gas emissions must be drastically cut across the whole economic infrastructure, and fast.

The clock is ticking. If proposed measures don’t get the results needed quickly enough, it’s likely there will be tougher interventions on the road to net zero.

Rather than waiting for this to happen, you can get ahead of the game and future-proof your packaging by looking into alternatives. For example, try changing the mix of a polythene product to include a minimum of 30% recycled film. Or replace polythene for a high-performance film that weighs less. Or even switch to a completely different material such as paper.

A lot of packaging suppliers are catching on to the importance of sustainability and are offering greener options. There is a vast array of innovations available, such as our own Eden range of eco-friendly packaging products.

What do plastic packaging manufacturers and importers have to do?

It doesn’t matter how eco-friendly their plastic packaging is, if they are manufacturing or importing at least 10-tonnes they still have to register with HMRC and keep meticulous records to demonstrate how much tax they owe, or if they are exempt.

The tax man wants to know the total weight of plastic packaging, percentage of recycled plastic therein, and weight of exempted plastic, along with proof of how they identified the materials and calculated the figures.

From 1 April 2022, plastic packaging manufacturers and importers will have to record these figures on a monthly basis. This will streamline processes such as proving compliance to business customers, claiming PPT credits, and completing their Plastic Packaging Tax return.

Those who fall below the 10-tonne threshold of finished plastic packaging don’t have to register for PPT, but they are expected to have documentation to prove they aren’t liable for the tax.

Altogether, around 20,000 operations will be impacted. Countless others will be indirectly affected as the cost of PPT payments, and the administrative burden of compliance, gets passed on through price increases.

And other organisations in the supply chain, such as fulfilment centres, will be required to do their due diligence. They can become liable if they work with a plastic packaging manufacturer or importer that has not paid the required PPT.

What type of plastic packaging is liable for PPT?

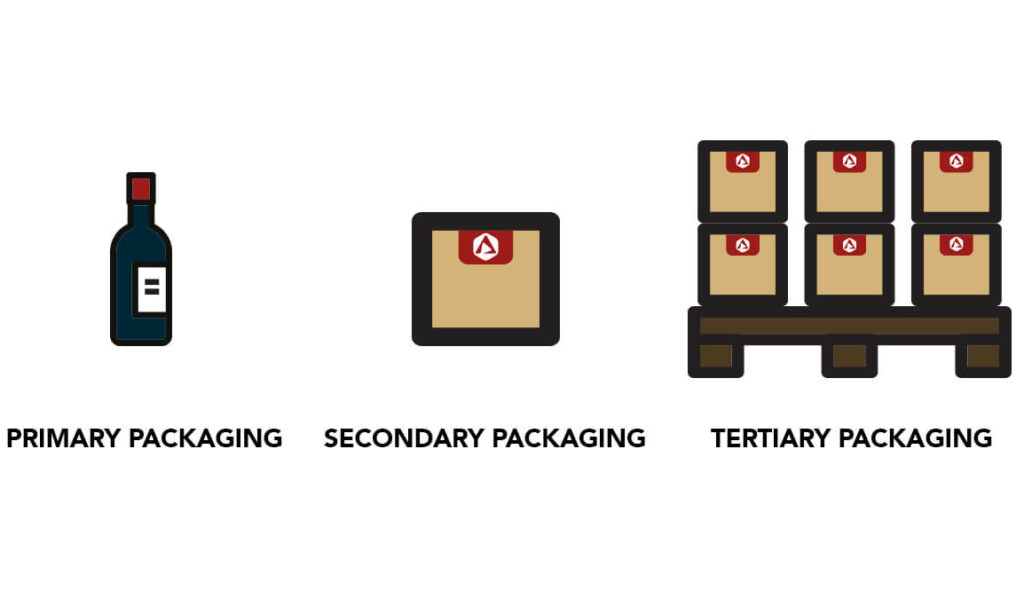

Plastic packaging used in the supply chain, or as single-use packaging for the end consumer, will be liable for PPT. Each individual component of plastic packaging is subject to the tax.

Products in the supply chain are those designed to contain, protect, handle, present, or deliver the goods. For example, trays, boxes, shrink wrap, plastic windows, film, labels presenting or describing the goods, tamper proof seals, and pallet wrap.

The charge will also apply to packaging used to transport goods within the UK, and to packaging that protects an individual item being imported into the UK.

Are there exemptions?

Yes, of course. Immediate plastic packaging used for licensed human medicinal products, and plastic components that won’t be used for packaging (such as plastic film for whiteboards), are both exempt from the tax. But they still count towards a business’s total weight of plastic packaging manufactured or imported.

PPT won’t be applied to packaging that protects multiple sales units being imported into the UK. This includes road, rail, ship, and air containers; plastic pallets; pallet wrap; and straps.

Packaging used in the long-term storage of goods (toolboxes, first aid boxes); that is an integral part of the goods (printer cartridges, inhalers); or reused for the presentation of goods (reusable sales display presentation stands or shelves), are also exempt.

What counts as plastic packaging?

No, it’s not a silly question. ‘Plastic packaging’ means components that are ‘finished’ and will not be modified any further before being used. Also, they can comprise a wide variety of materials. So, for the sake of simplicity, a component is considered ‘plastic’ as a whole, and its total weight liable for PPT, if it contains a larger percentage of plastic than non-plastic substances.

What about exports?

Plastic packaging manufacturers can defer paying the tax for up to 12 months if their packaging is going to be exported. And it’s worth pointing out that PPT should not be paid twice on the same item. Packaging that has already been subject to the tax, and is subsequently exported further down the chain, should not require an additional PPT payment.

When did this take effect?

Plastic packaging manufacturers and importers had to register for Plastic Packaging Tax from 1 April 2022. Now, registration is required within 30 days of becoming liable (in other words, upon meeting the 10-tonne threshold for finished plastic packaging).

They have to complete a PPT return to HMRC every quarter. The accounting periods are 1 April to 30 June; 1 July to 30 September; 1 October to 31 December; and 1 January to 31 March. Returns must be submitted, and tax paid, by the end of the relevant accounting period or there will be penalties.

Remember, you don’t have to produce any paperwork or pay the tax if you are just buying the finished packaging to protect your products. However, you may find that your packaging is more expensive than before PPT was introduced.

If have any questions about Plastic Packaging Tax or would like some advice on eco-friendly packaging alternatives for your operation, get in touch.